“I made a mistake that I see my clients make all the time.”

A few months ago, while on vacation, I got into a little accident with my rental car. Right in the rental company’s own parking lot! (After a grueling tax season, my brain was still in recovery mode.) When I opened the itemized repair bill and saw $3,000, my blood boiled. What started as a simple dent had mysteriously morphed into repairs on three sides of the car!

Las Vegas Business Owner Learns Painful Truth: $18,000 in ‘Deductions’ Worth $0 – But There’s Hope for Next Year

Las Vegas Business Owner Learns Painful Truth: $18,000 in ‘Deductions’ Worth $0 – But There’s Hope for Next Year Author – Adam Hodson | June 25th, 2025 A Las Vegas business owner had meticulously tracked $18,000 in deductions for their 2024 tax return, only to learn they wouldn’t save a single dollar in taxes. During […]

Las Vegas Small Business Owner Discovers $2,580 in Annual Tax Savings Through Professional Tax Planning

A Las Vegas tech consultant and QuickBooks user was paying more in taxes than necessary – not because of complex tax strategies he was missing, but due to simple bookkeeping and tax documentation issues that could be easily fixed. During a one-hour summer tax planning session with our firm, we uncovered several completely legal tax-saving opportunities that were being overlooked…

Instructions for Personal Extensions

The extension extends the time to file your return, but NOT THE TIME to pay your taxes. We will file an electronic extension on your behalf, but the interest still accrues on any unpaid taxes as of April 15th …

Beneficial Ownership Information Report (BOI)

Are you confused on if you have to file the Beneficial Ownership Information Report (BOI)? Well, you are not alone, so are we. Earlier this year we sent out a few reminders to get your BOI filed by the end of this year. While it is frustrating to have information constantly changing, we are doing our best to always stay up to date and keep you informed.

The Closest Thing to Free Money in the Tax Code: The Health Savings Account

The Closest Thing to Free Money in the Tax Code: The Health Savings Account Author – Adam Hodson | November 20th, 2024 What if I told you there’s a way to turn your medical expenses into tax deductions AND build a tax-free investment account at the same time? Welcome to the Health Savings Account (HSA) […]

The S-Corporation Horror Stories: Tales from the Tax Crypt

The S-Corporation Horror Stories: Tales from the Tax Crypt Author – Adam Hodson | October 29th, 2024 On a dark and stormy night, as the clock strikes midnight, gather ’round as I share some terrifying tales of S-corporation nightmares that have haunted unsuspecting business owners… The Phantom Payroll In the quiet town of Businessville, Sarah […]

Year-End Tax Planning: More Than One Way to Enjoy the Holidays

Year-End Tax Planning: More Than One Way To Enjoy The Holidays Author – Adam Hodson | October 15th, 2024 Imagine sitting at your desk, not with a headache from running your business or trying to make holiday plans, but with a smile, knowing you’ve just saved thousands on taxes and set your business up for […]

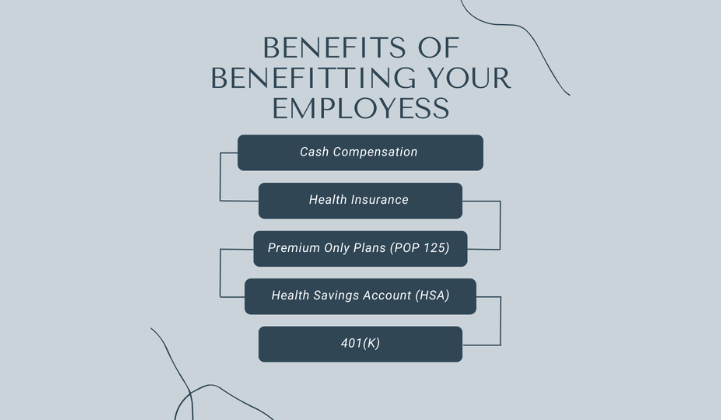

Benefits of Benefitting Your Employees

Benefits of Benefitting Your Employees Author – Adam Hodson | October 1st, 2024 In today’s competitive job market, finding and retaining top talent is more challenging —and expensive—than ever. As a small business owner, you might think that offering attractive compensation packages is out of reach. However, there are several smart strategies you can employ […]

Big Changes for Small Businesses: The Corporate Transparency Act Explained

Adam was on the radio discussing the Corporate Transparency Act, you can listen HERE, or for a quicker explanation, you can read the cliff note version: